(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are highly likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 81.5% (5th overbought day)

VIX Status: 13.6

General (Short-term) Trading Call: Initiate SMALL short positions, sell some longs

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

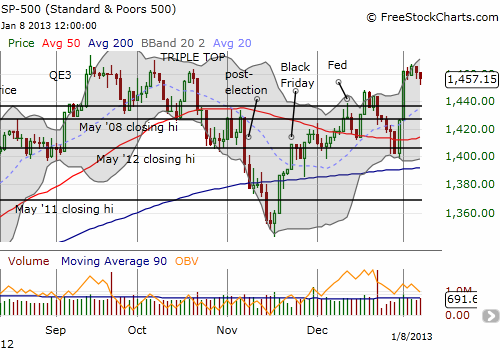

Somehow, the S&P 500 remains extremely overbought despite meandering ever so slightly lower. I assume that the persistence of extreme overbought conditions at the resistance of multi-year highs indicates that a spring is still winding tighter and tighter, ready to burst upward or downward with a well-placed catalyst.

In the meantime, the volatility index, the VIX, continues to trickle ever so slightly downward. It still looks ready to take a quick plunge lower before finally turning higher again (which I have stated in earlier posts seems highly likely within a month). This low VIX is adding to the tension building in the market.

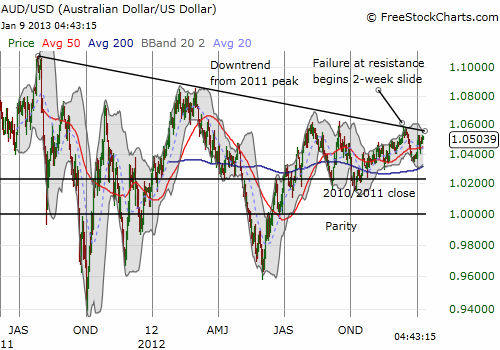

There are three other indicators that are trading on the edge of important trendlines: the Australian dollar (FXA), gold (GLD), and the dollar index. I am long overdue to update the on-going relationship between the Australian dollar and the S&P 500. In the meantime, I think this relationship is alive and well. AUD/USD continues to trade right at the edge of a downtrend in place ever since the currency pair’s all-time high set in 2011. I have argued that this downtrend will hold, but if it does not, I expect it will be accompanied by a fresh surge higher in the S&P 500.

Gold’s breakout last August in anticipation of QE3 came to an end in November as it retested the 200DMA. A fresh bounce essentially failed at the 50DMA and now gold, as represented by the SPDR Gold Trust (GLD), is struggling to hold onto the 200DMA support. I remain as bullish as ever on gold, but I think further selling from here could gather momentum quickly.

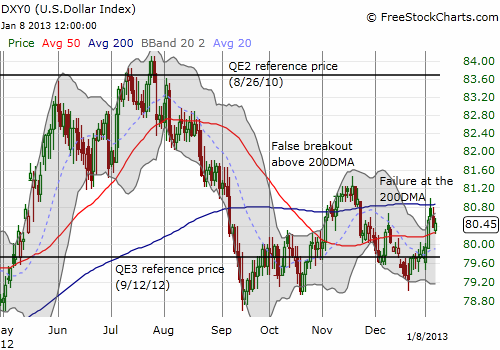

Related to AUD/USD and GLD, the dollar index is once again knocking at the 200DMA. A breakout in November was surprisingly brief. I think another breakout here will be sustained. In previous posts, I have demonstrated how the dollar index tends to sustain large rallies/sell-offs once it breaks the 200DMA up/downward.

These are all trends/transitions worth watching as we wait for the market to make its next (explosive) move…

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long VXX shares and puts; long SSO puts, long GLD